AKR realizes that risks have become an integral part of every business process. These risks are inherent in all activities and decision making and the impact of these risks can significantly influence the stability of the Company.

In line with its business development, AKR needs a risk management system that is able to manage all forms of uncertainty as the Company’s focus. Risk management is becoming increasingly important as a basis for decision making by the Company to ensure that the Company’s wheels of business continue to move forward.

isk Management is a culture, where processes and structures are directed at appropriate management of potential opportunities and adverse impacts.

CORPORATE RISK MANAGEMENT

Risk is the responsibility of all parties in the Company to be involved in its management. The Company’s risk management is carried out through a top-down approach that involves the Board of Directors in evaluating the main risks as a whole; and a bottom-up approach that involves the Leaders of Departments/Branches/Subsidiaries in assessing specific risks in each business/business unit. Risk management is carried out jointly/in coordination with ERM Dept. at the Head Office using the established risk management reference, framework, policies and procedures

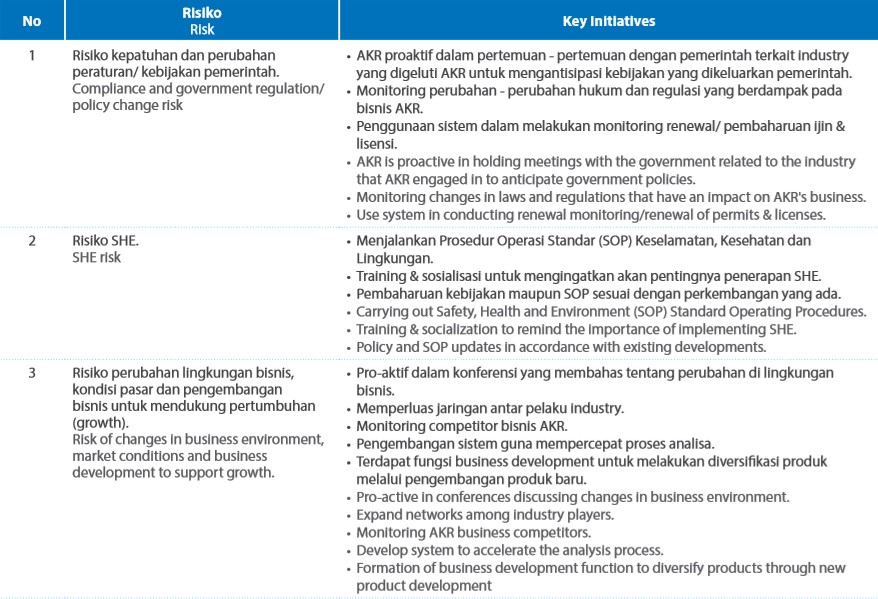

RISK FACED BY THE COMPANY AND RISK MANAGEMENT EFFORTS

- Country Risk, Indonesia’s macroeconomic conditions, political conditions, and government regulations affect the Company and other companies operating in Indonesia

- Economic and Political Risk. The Company’s operational activities are strongly influenced by inflation rate, Gross Domestic Product growth, taxation, and various developments in the political and economic fields in Indonesia.

- Government Policy Change Risk The Company faces the risk of changes in government policies that could inhibit the Company’s business activities domestically. Changes in government policy can relate to taxation, currency controls, and the Company’s performance. Almost all petroleum products, and some of basic chemical products, traded and distributed by the Company, is imported from abroad. Policy changes, import bans, import quota restrictions, import fee regulations, or import tariffs could inhibit or cause an increase in import costs that could affect the Company’s performance. Subsidized petroleum distribution contracts granted for subsequent years are based on a government tendering process and the continuation of government deregulation policy. However, the granting of government contracts in the future depends on the ability of the Company to meet various criteria.

- Industry Risk Supply and demand from the industry the Company operates also influence the Company’s performance. The trading and distribution segment is influenced by demand for basic chemicals and petroleum. Demand for basic chemicals and petroleum also relies on the economic conditions in Indonesia, as well as its neighboring countries. The logistic services segment also encounters demand risk. The Company provides logistic and distribution services and infrastructure facilities to third parties in Indonesia. The economic slowdown in Indonesia and worldwide influences international trading, which in turn can cause a decrease in shipping activities and the demand for logistic services. The risk of supply shortages, and rising prices of raw materials, may occur in the manufacturing segment. Natural disasters and climate change could cause supply shortages followed by rising raw material prices, with the cost increases not always being possible to pass on to the customer selling prices, which will affect the Company’s performance. In addition to the demand and supply risk, the Company faces competition risk from other companies that have similar business activities to the Company. To anticipate this risk, the Company has increased its operational capacity, maintained good relationships with suppliers and improved the quality of service to customers.

- Operational Risk, Operational Risk will occur if the Company fails to follow the standard operating procedures needed due to climate change, natural disasters, broken supply chains, unsuccessful production, information technology, and employee management failure. These risks are associated with daily operations of the Company. Therefore, the Company has set standard operating procedures that are continuously being updated and enhanced, so that the risks are minimized and the Company is in line with the demands of business and technology. The Company is also building technology and operating systems backup if the primary systems fail to operate. Employees responsible for the systems are given regular training to enhance their skills and vigilance in dealing with other operating systems and tools.

- Safety, Health and Environment Risk The Company may be exposed to risk in Safety, Health and Environment (SHE) given that the Company is engaged in basic chemicals and petroleum distribution, manufacturing, and logistic services. These risks include fires, spillages, errors in the handling of waste, equipment failures, system failures, etc. SHE risk not only affects the Company but also affects people around the operational areas. In order to avoid such risks, the Company implements strict and detailed regulations concerning occupational safety and provides training to employees to deal with undesirable conditions. SHE procedures are constantly being updated in accordance with government and organization regulations as well as certification in particular areas.

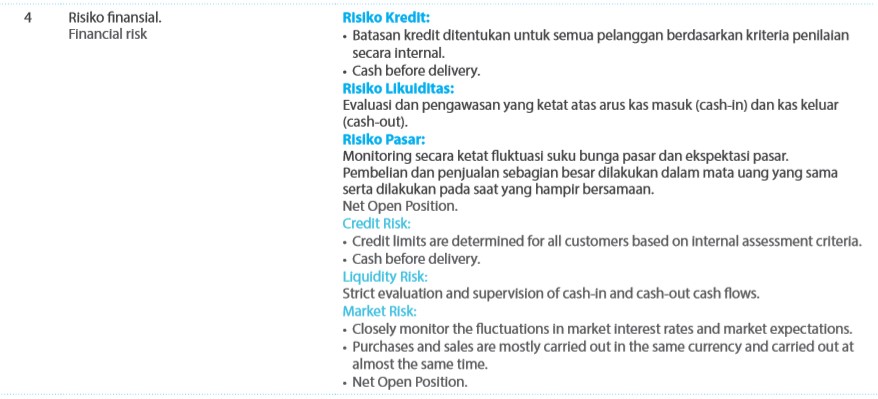

- Financial Risk, The main risks faced by the Company related to financial instruments are credit risk, market risk (including interest rate risk, foreign currency exchange rate risk, and commodity price risk), and liquidity risk. The Company’s financial risk management has been presented in detail in the consolidated financial statements audited by the Public Accounting Firm Purwantono, Sungkoro & Surja.

RISK MANAGEMENT REPORT

EVALUATION OF RISK MANAGEMENT SYSTEM EFFECTIVENESS

The risk management has contributed positively to the process of planning, decision making, and strengthening the implementation of Good Corporate Governance (GCG) in the Company. The risk management system applied by the Company is able to minimize and/or reduce the level of impact and possibility of risk. This can be seen from the effectiveness of quality, quantity, and time of completion of a predetermined risk mitigation plan. This risk management system can support the Company in achieving significant revenue growth until reaching the established targets.

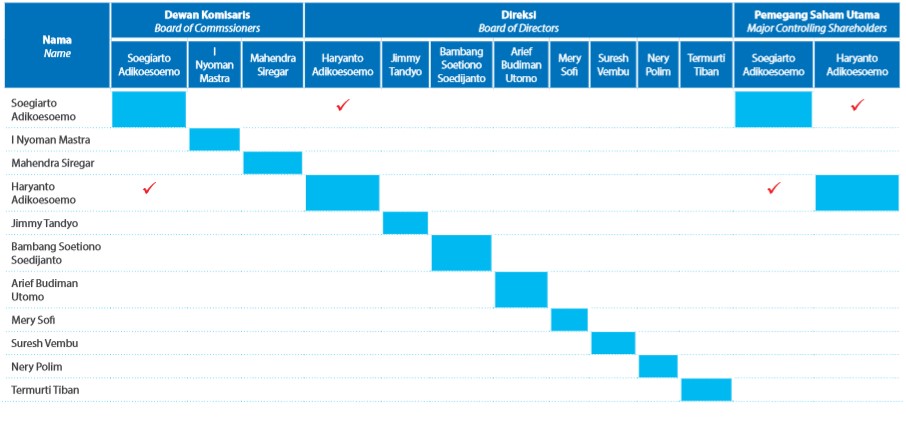

ACTIVE ROLE OF BOARD OF CIMMISSIONERS AND BOARD OF DIRECTORS

The overall role of Board of Commissioners in terms of risk management is:

- Provide direction and recommendations to the Board of Directors in overseeing the risk management practices and implementation in the Company.

- Review and ensure that the Company and its subsidiaries have a risk management framework and process that is appropriate for existing business needs.

While the role of Board of Directors includes:

- Developing a risk management culture at all organizational levels with a tone from the top approach where the development of risk culture starts from Top Management.

- Ensuring the effectiveness of risk management implementation, such as ensuring it becomes an integral part of the Company’s operational activities.

- Reviewing the Company’s risk profile and reports, this includes ensuring & providing views regarding the main risks that must be prioritized in risk mitigation.

- Review the mitigation controls that have been determined to ensure the realization of implementation is sufficient and timely. 5. Ensuring the adequacy of human capital in managing strategic risks including the level of tolerance and risk treatment for each strategy.