- ID

- EN

Based on Article 3 of the Company’s Articles of Association of which the amendment already approved at the Extraordinary General Meeting of Shareholders (EGMS) dated May 5, 2015, the Company’s intention and objectives are to engage in industry, trading, transportation, representative and/or agency, contractor, and services.

To achieve these objectives, the Company conducts the following business activities:

Main Business Activities

Supporting Business Activities

The Company’s business activities are as follows:

TRADING AND DISTRIBUTION

The trading and distribution segment is the main pillar of the Company’s business. In this segment, the Company focuses on two main products, namely Petroleum products and basic chemicals.

industrial Petroleum The Company has developed its non-subsidized fuel distribution business since 2005, and since then has continuously expanded its logistics network facilities for fuel distribution to customers, especially to serve customers in commercial, industrial, mining, power plants, bunker, etc. The Company has tank terminal facilities in

several locations in Indonesia with a total capacity reaching 734,000 KL.

One of the Company’s strengths in this business is the Company’s reliable supply chain management, ensuring the capacity, quality and on time fuel distribution to its customers in Indonesia. This is also supported by operation of the Company’s shipping vessels comprising tankers, barges and Self-Propelled Oil Barges/SPOB to distribute through sea or river. The Company vessels are especially designed to deliver fuel in shallow waters up to 2.7m in regions in Kalimantan. The company also has a fleet of over 300 trucks to deliver products across Indonesia.

Since end August 2018, Ministry of Energy and Mineral Resources announced the mandatory use of Biodiesel (B20 policy) for all industrial and transportation users with limited exceptions. AKR received the largest quota of FAME (Fatty Acid Methyl Ester) for blending amongst private companies.

Retail Petroleum The capacity and experience of the Company in distributing non-subsidized fuel made the Company gained the trust of BPH Migas to distribute subsidized fuel since 2010 through the Motorized Vehicle Refueling Station (SPBKB) and the Fisherman Filling Station (SPBN) with AKR brand. By the end of 2018, the number of outlet stations owned by the Company had reached 135 in various parts of Indonesia, including Sumatera, Java-Bali, and Kalimantan.

In 2018, the Company received allocation of subsidized fuel distribution in the amount of 250,000 Kl from BPH Migas and The Company is appointed as Business Entity Executive of P3JBT for 5 years. AKR is also participating in the program of one price policy in area of 3T (The most Underdeveloped, The Frontest, and The Outermost)

With a well-organized terminal network and large transportation fleet, the Company can carry out such trust well and strengthen the Company’s position as one of the main players in the BBM distribution business.

In April 2017, the Company announced the signing of a retail joint venture in Indonesia with BP. The Joint Venture formed a company called PT Aneka Petroindo Raya, which operates under the name “BP AKR Fuels Retail”. In an exclusive agreement, both parties intend to develop and offer different experiences to consumers by leveraging the capabilities and expertise of BP and AKR in the emerging retail market in Indonesia. Two Petrol stations of BP-AKR opened in 2018, and plan to open more petrol station in Indonesia going forward. The retail sector will be a future growth factor for the fuel segment.

Basic Chemicals

AKR is the principal distributor for Asahimas Chemicals, and has distributed basic chemicals such as chloroalkali, solvents, organic and non-organic chemicals from its establishment in the 1960s. The Company also trades and distributes chemicals obtaining supplies from domestic and foreign suppliers. To support its business, in 1970, the Company built its first tank terminal in Indonesia. This innovation was one factor that helped the Company become a chemical distributor company with the largest market share in Indonesia.

Besides having adequate infrastructure, the Company also has strength in terms of its supply chain and integrated logistics. The combination of the infrastructure and the capability logistics supply chain lead to the Company gaining trust from various industries in Indonesia who need basic chemicals, such as industrial consumer goods, textiles, glass, etc.

Lubricant

The Company conducts business in the field of trading and distribution of lubricants for the industrial, marine, mining and commercial vehicles sectors with the Castrol brand.

LOGISTIC SERVICES

The Company has a complete and integrated logistics infrastructure, from warehouses, storage tanks, ships to trucks in Indonesia. Therefore, the Company can offer efficient logistics and distribution infrastructure solutions to third parties, by providing effective and reliable bulk cargo management services in major ports in Indonesia.

The Company, through its subsidiary, PT AKR Transportasi Indonesia, provide land transportation services to support its logistics and distribution services. The Company continues to develop the infrastructure that is needed to receive, store, and transport a variety of products in the ports.

vendor Managed inventory

The Company offers Vendor Managed Inventory (VMI) systems to its major customers. The Company manages the petroleum inventory at its customers’ premises, so that they will only need to pay for how much they use. In return, the Company will ensure availability and efficiency through inventory management for these customers. VMI is the Company’s commitment to deliver added value to customers.

MANUFACTURING

The Company’s manufacturing segment is currently an adhesive product manufactured by the Company’s subsidiary, PT Arjuna Utama Kimia (Aruki) in Surabaya, East Java. Aruki supplies adhesive to various companies in the wood and paper industry in Indonesia.

JAVA INTEGRATED INDUSTRIAL AND PORT ESTATE (JIIPE)

As a part of its expansion strategy, AKR is currently developing the Java Integrated Industrial and Port Estate (“JIIPE”) located in Gresik in East Java, with the objective of providing logistics and energy solutions to industrial customers. JIIPE features a deep seaport integrated with a large industrial estate with good interconnectivity to the fast-growing province of East Java. With a total area of around 3,000 hectares, the project will be one of the largest integrated industrial and port estates in Indonesia. The total area under development is 1,761 hectares of land for the industrial estate, 406 hectares of land for the Sea Port and 800 hectares of residential and commercial space being developed by affiliat

industrial estate

JIIPE industrial estate area covering 1,761 hectares is located in Gresik with excellent conectivity, accsess to deep water port and conectivity to hinterland. The industrial estate provides complete utilities and facilities. This area is strategically located and has the potential to become a trade center and manufacturing center for Indonesia and the Asia Pacific.

Grouping of light-medium-heavy industries is well planned to and the internal road access infrastructure is well plan to facilitate smooth operation.

Logistics costs for incoming raw materials and distribution of finished goods will be competitive by the utilization of modes of sea and land connectivity (deep sea ports, railways, toll roads). JIIPE has a toll connectivity to Surabaya as the second largest city in Indonesia, as well as planned direct toll connection and rail connection to the double track railway network that has access to points in Java.

The JIIPE industrial estate is facilitated by an international standard road system, direct piping connections, one-gate processing system, and 3-hour investment licensing services that make it easy to do business.

PT AKR Corporindo Tbk. hereinafter referred to as “AKR” or the “Company”, has gone through a very long journey in the world of Indonesian and international business. Established in Surabaya on November 28, 1977 under the name of PT Aneka Kimia Raya, based on Deed Number 46 dated November 28, 1977 passed before Sastra Kosasih Notary in Surabaya, AKR initially engaged in trading basic chemicals. The Company built many basic chemical storage tanks and warehouses in several major ports in Indonesia that made the Company the largest chemical distributor in Indonesia in the 1970s.

In 1985 the Company moved its head office to Jakarta and climbed a new chapter in the development of its business by becoming a public company listed on the Indonesia Stock Exchange. The Initial Public Offering (IPO) was held on October 3, 1994 with the AKRA stock code and the Company added to the business sector not only focusing on the trade of basic chemicals.

In 2004, the Company changed the name of the company to PT AKR Corporindo Tbk. along with the addition of the Company’s business lines which no longer only focus on the basic chemicals business. In the articles of association owned, the Company’s activities in addition to chemicals and petroleum and gas; also includes business in the fields of logistics, transportation services, warehouse and tank rental, workshops, expeditions and packaging, building contractors and services (except legal services) as well as conducting business and acting as representatives and/or agencies of other companies both inside and outside the country.

The government recognition of the development of PT AKR’s business in the form of deregulation of the oil and gas sector and in 2005, the Company listed itself as the first national private company operating in the Non-Subsidized BBM business and gained the trust of the Downstream Oil and Gas Regulatory Agency (BPH Migas) to distribute subsidized fuel to several regions in Indonesia since 2010. The Company has implemented an integrated technology system that is innovative in monitoring and controlling the distribution of subsidized fuel. The last year’s achievement obtained by AKR from the Government was the establishment of the Company as an Executing Agency for P3JBT (Executing Agency for the Supply and Distribution of Specific Types of Fuel) for 5 years.

The Company started to collaborate with Pelindo III for the development of JIIPE project in East Java, then the Company also signed Heads of Agreement between AKR and BP for retail cooperation in 2016, also signed Lubricant Distribution Agreement with CASTROL in 2017. The Company formed joint venture with BP Global namely PT Aneka Petroindo Raya to setup BP AKR retail in Indonesia. The Company also incorporated PT Dirgantara Petroindo Raya along with Air BP to expand opportunities in Aviation fuel. With an extensive logistics network, the Company has become one of the largest private distributors in the field of logistics services and solutions for the procurement of petroleum and basic chemicals in Indonesia

In 2018, AKR further strengthened its positioning as a fuel distribution company by opening BP AKR gas stations. Until the end of 2018, there have been 2 (two) BP AKR gas stations located in De Latinos, Serpong and in Jababeka, Cikarang.

Along with the ongoing transformation process, PT AKR Corporindo Tbk keeps moving forward. After strengthening its business foundation in 2017, the Company conducted expansion and development to optimize all potential available

Dear honorable Shareholders and Stakeholders,

We have successfully closed 2018 with a series of proud achievements. This proves that the transformation process we have carried out on the back of three main pillars is the right business strategy for the growth and sustainability of PT AKR Corporindo Tbk in a long term.

This Annual Report is themed “Moving Forward with the Right Strategy”, which summarizes important values of all positive performances achieved in 2018. The theme becomes more significant when considering that in 2018 the Company has strengthened its position as a leading player in the trading of petroleum, logistics, and supply chain business segments in Indonesia.

2018 ECONOMIC CONDITIONS

The global economic and financial conditions in 2018 ran the risk of uncertainty. Trade tension between the United States and China significantly impacted the global economy. Moreover, the United States Federal Reserve (the Fed)’s policy to raise its benchmark interest rate also added to the global economic uncertainty.

Responding to these conditions, China initiated a measure to depreciate its currency, which gave rise to turmoil in the global financial markets.

As part of the world economic ecosystem, Indonesia’s economic condition is also affected by the global economic condition. For almost the whole year 2018, Rupiah exchange rate, especially against the US Dollar, was depreciating. In fact, in October 2018, the Rupiah exchange rate was at Rp15,200/ USD, or the lowest since the 1998 economic crisis.

The global economic uncertainty gave rise to Indonesia’s Trade Balance’s deficit in 2018. The Central Statistics Agency (BPS) recorded that Indonesia’s export value in 2018 only increased by 6.65% to USD 180.06 billion, while the import value grew at the faster pace of 20.15% to USD188.63 billion, resulting in Indonesia’s trade deficit of USD 8.57 billion in 2018. This was the first trade deficit in the last four years.

In the midst of such conditions, Indonesia’s economy still had a higher growth of 5.17% in 2018 from the previous year’s GDP growth of 5.07%. This stronger growth of Indonesia’s GDP was attributable to the stronger consumption spending coupled with good management of inflation by the Government. Inflation rate in 2018 was recorded at 3.13% or lower than that in 2017 of 3.61%. However, Bank Indonesia decided to increase its 7-Day Repo Rate by 175bps in phases to 6.00% at the end of 2018 compared to the previous year’s position of 4.25%.

STRATEGIC INITIATIVES

In 2018, AKR focused on the transformation process that has been carrying out since 2017. A range of improvements related to work process, human capital and information technology are continuously made and enhanced. Moreover, since 2017, the Company has focused on developing business potential within the country.

After divesting of its river port in China in 2017, in 2018 the Company continued the divestment process of Khalista, the Sorbitol producer in China. The divestment process, including auction of Khalista’s land by the local government, was completed at a very good price in 2018. Divestment of Bumi Karunia Pertiwi which engaged in the coal mining business was also completed in March 2018. These completed divestments have strengthened the Company’s cash position, which enables the Company to harness all opportunities available in country.

In 2018, JTT commenced expansion of AKR-Vopak Terminal capacity from 250,000 kilo liters to 350,000 kilo liters. This additional capacity was to anticipate the growth of demand for Gasoline and Biofuel B20, where since 1 September 2018 Company has also been trusted to distribute B20. AKR is committed to fully supporting the Mandatory B20 Government Program for all industry players.

In the petroleum distribution business, in 2018 the Company commenced the operation of BP AKR non subsidized gas stations (SPBU) under a joint venture with BP. Until the end of 2018, 2 BP-AKR gas stations in Serpong, South Tangerang, and Jababeka, Bekasi, have started to operate. AKR BP SPBU has a different concept compared to other SPBU, where the Company collaborates with strategic partners in providing one stop service to customers. This SPBU is complemented with lubricants sales, vehicle maintenance provided by SiTepat/ Castrol, retail services from Alfamart, coffee from Kopi Tuku, F&B Services and others.

The Company managed the risk of commodity price movements effectively. in Trading & Distribution sector, the Company uses a formula to determine selling price of its petroleum products to mitigate the impact of currency fluctuation and volatility of oil price. The basic chemical products is predominently commission based and the prices are determined in consultation with our principals. The Company also effectively managed the foreign exchange movements during the year.

CHALLENGES

The global and domestic economic conditions in 2018 are distinctive challenges for the Company. Domestically, Indonesia will enter a political year in 2019 which makes many businesses delay their investment and business expansion. This can be seen from the decline in sales of industrial estate evenly throughout Indonesia, including the Java Integrated Industrial and Ports Estate (JIIPE).

However, this condition has become an opportunity for the Company to strengthen infrastructure in the first industrial estate in Indonesia that is integrated with the port. Since 2018, the Company has started selling power from its power plant to industrial clients. In addition, other facilities, such as fiber optics, gas pipelines, clean and waste water treatment have also been functioning properly, so JIIPE is ready to welcome new tenants in 2019.

Back on March 9, 2018, President Republic of Indonesia, Joko Widodo inaugurated JIIPE. In his remarks, the President hoped that in the future there would be more industrial estates integrated with ports to reduce logistics costs. This is in line with the Company’s vision.

Another challenge facing the Company came from human resources development. Rapid changes in the business world demand changes in working patterns and culture. In 2018, in line with the transformation process carried out, AKR introduced a new work culture. The work culture is expected to increase employee productivity without prejudicing the right and comfort at work

AKR 2018 PERFORMANCE

Despite the various challenges, in 2018 AKR recorded quite an encouraging operational and financial performance and in general managed to achieve the set targets. From the operational side, the Company succeeded in achieving the following:

In terms of finance, the Company posted an outstanding performance improvement, including:

With this achievement, the Company was able to maintain the positive trend achieved in the last 5 years.

THE COMPANY’S BUSINESS PROSPECT

The global economy is predicted to record better growth in 2019. The US-China trade war is expected to end after the leaders of the two countries agree to hold a meeting in April 2019. In addition, the Fed has also revised its plans and now still hold its interest rates.

The Indonesian economy is also predicted to record positive growth. Indonesia’s economic fundamentals are considered strong enough in facing various global economic challenges. Although there will be no significant hike, Bank Indonesia predicts that the Indonesian economy will grow in the range of 5.1% – 5.4%.

The Company is optimistic to enter 2019. A range of preparations made in 2018 will have a positive impact on the Company’s revenue and profitability in 2019.

The trading business segment, which is the largest contributor to revenue shall contribute to grow with improving demand for High Speed Diesel from mining, power and commercial segment. The retail sales volume will increase with growth in retail network of AKR Petrol Stations as BPH Migas has assigned the company as the Business Entity Agency for the Distribution of Certain Fuel types until 2022.

The Company will also continue to increase the number of AKR BP SPBUs to target the growing retail segment. The addition in terminal capacity will also become a factor supporting the increase in the petroleum distribution and sales segment.

In addition, as part of its collaboration with BP, in 2019 the Company is in the process of preparation to enter the aviation market, where demand of jet fuel has been growing in line with the airlines industry in Indonesia.

The chemicals sales and distribution volume will also increase along with the opening of new plants in several regions of Indonesia. In addition the main principal of the Company has also added capacity to 700,000 MT in 2017.

In Industrial Estate area segment, the Company expects JIIPE to provide stronger contribution in 2019. With the improving industrial sectors in 2019, sale of industrial land to tenant shall improve. With the complete facilities currently available, JIIPE will also become the top choice for companies in the industry sector and become the Company’s recurring income. Starting 2018, utilities has generated revenue for the Company.

Adequate cash balance, strong balance sheet and capital base will enable the Company to carry out various business developments that have ample potential in 2019.

DIVIDEND POLICY

The Company is committed to providing optimal returns to Shareholders. At the Annual GMS held on May 3, 2018, the Shareholders decided to distribute cash dividends amounting to Rp801,483,719,000 or 66.69% from the net profit attributable to the owner of the parent entitu of the financial year of 2017 less the amount of interim dividends previously distributed.

In addition, the Company also distributed interim dividends of Rp120 / share in 2018.

HUMAN CAPITAL

AKR is very aware of the importance of human capital development, competencies and career. Therefore since the end of 2017 the Company has been focusing on the organizational and business transformation process.

In 2018, AKR introduced new Corporate Values, namely Be entrepreneurial, Collaborate, Reward for Performance, Be Agile, Empower your Team, Zero Tolerance. We have also conducted an internal review through the Organizational Culture Health Survey to find important points that contribute to cultural imbalances organization (Potentially Limiting Value / PLV).

In 2018, as a follow-up to AKR’s strategic initiatives related to corporate reorganization, the Board of Directors formed People Development Committee (PDC) which functions as career development advisor for employee.

The Company has started Macan Leadership Institute (MLI), with its programs. In 2018, MLI ran 5 excellent programs: Onboarding Program, Leadership Development Program, Head of Branch Academy, Sales Academy and Top Talent Program

INFORMATION TECKNOLOGY

Information technology (IT) is an important part of the AKR transformation process. During 2018 AKR aggressively increased and made innovations in business processes through IT empowerment. In order to provide effective results and ensure alignment with business demand, IT organization has been restructured to carry out more strategic roles such as introducing IT as Business Partners to increase the availability of services in a timely manner, as well as to find out and track incidents more efficiently.

In 2018, the Company completed the distribution system upgrade process. The system will be linked to the Company’s ERP, which will also be upgraded in 2019. IT is also expanding services to subsidiaries including in retail and logistics.

SAFETY, HEALTH AND ENVIRONMENT

As a responsible corporation, the Company provides support and commitment to preserve the earth through various policies and real actions in the field. With this effort, the Company partakes in reducing the negative impact of the earth’s environmental damage on humans, while also benefiting future generations to enjoy a better life on earth. The sustainability of life on earth will undoubtedly be a blessing for the Company’s sustainability.

Concern for the environment is carried out by the Company directly or indirectly. Indirectly refers to the concern for safety and health. This is intended to prevent work accidents, which allow environmental damage such as oil fuel spills, workplace fires, etc. To that end, the Company routinely conducts various trainings to realize zero accident, as well as employee health campaigns.

In 2018, the Company obtained Zero Accident awards for the Bitung, Ciwandan, Banjarmasin, Stagen and Palaran branches.

CORPORATE GOVERNANCE

AKR establishes Good Corporate Governance / GCG as the main pillar in every operational activity of the Company. All activities and strategies carried out by the Company must be in accordance with the applicable laws and regulations and prioritize the interests of Shareholders and other Stakeholders.

As part of the implementation of GCG principles, the Company for the first time conducted a risk management audit in 2018. The Company realizes that in the midst of economic conditions and more stringent competition, the risks faced by the Company are becoming increasingly complex. Therefore, the Company intends to ensure that all procedures in risk management implementation are carried out properly and correctly, so that the Company can avoid all of these risks.

The Company has applied the principle of transparency by always reporting its business activities to OJK and Indonesia Stock Exchange as well as other related parties within the stipulated deadlines.

To assess compliance of the Company’s GCG implementation with prevailing legislation, in 2018 AKR also conducted GCG assessment using the ASEAN Corporate Governance Scorecard criteria. This was also part of the Company’s efforts to continue improving the quality of GCG implementation.

CORPORATE SOCIAL RESPONSIBILITY

The Company runs a structured and sustainable Corporate Social Responsibility (CSR) program. CSR has become an integral of the Company’s operational activities. Not only continuing with the community and employee welfare assistance as well as environmental responsibility, in 2018 the Company carried out CSR activities with new concepts, i.e. customers and the government approach,

In 2018, the Company inaugurated the operation of SPBKB in Way Tenong-West Lampung, also in Sepangah & Seluas-West Kalimantan, as a distributor of One-Price fuel in the 3T region and opened a Basmalah Shop in SPBKB Grati and Tongas, East Java, in collaboration with Islamic Boarding Schools.

In addition to these activities, the Company also continued to carry out community social activities, including renovation of school building, facilities and infrastructure, scholarship programs, provision of ambulances and various other activities.

The Company also took part in handling victims of the earthquake and tsunami disaster in Donggala, Palu and tsunami disaster in the coast of Banten-Pandeglang. In addition to providing assistance in the form of ready-to-eat food, clothing and medicines, the Company also provided assistance in the form of fuel for heavy equipment vehicles used for evacuations and operational vehicles of Basarnas (national rescue agency).

AWARDS

In 2018, AKR also received a number of awards from independent parties which at the same time were testament to the right management of the Company, including:

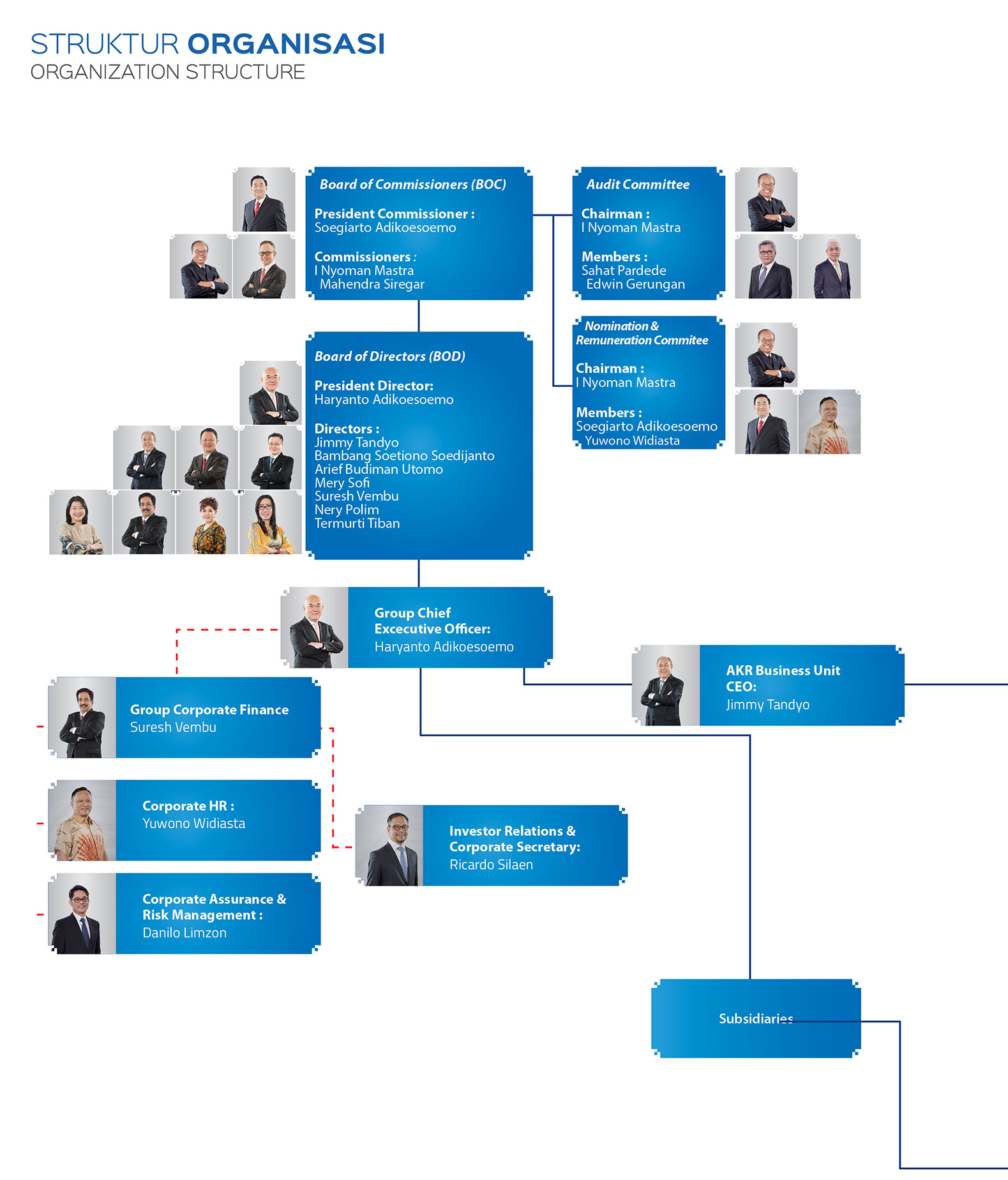

CHANGES TO THE BOARD OF DIRECTORS’ COMPOSITION

In 2018, there was no change in the Board of Directors composition of PT AKR Corporindo Tbk. The Board of Directors composition as of December 31, 2018 is in accordance with the resolution made in the Annual General Meeting of Shareholders dated May 5, 2015, namely:

Haryanto Adikoesoemo : President Director

Jimmy Tandyo : Director

Bambang Soetiono Soedijanto : Director

Arief Budiman Utomo : Independent Director

Mery Sofi : Director

Suresh Vembu : Director

Nery Polim : Director

Termurti Tiban : Director

APPRECIATION

We have successfully ended 2018 with a proud performance achievement. On behalf of the Board of Directors, we would like to extend our heartfelt gratitude and appreciation to all AKR employees who have worked with high enthusiasm and dedication. We also would like to extend our gratitude and appreciation to the Board of Commissioners for providing directives in corporate governance.

On behalf of the Company, we also would like to extend our sincere gratitude to our customers and business partners who have contributed to the development of the Company’s business, Shareholders who consistently provide full support for the Company’s development from time to time, and to regulators as policy makers.